Recruiter.com’s monthly survey of recruiters and HR and talent acquisition professionals shows candidates are losing interest in new roles while employers are offering more money and loosened requirements to attract them.

HOUSTON, TX — July 1, 2021 — Recruiter.com Group, Inc. (Nasdaq: RCRT), an on-demand recruiting platform, today announced the results of the June 2021 Recruiter Index®, a monthly survey of Recruiter.com's network of more than 28,500 independent recruiters and talent acquisition specialists. While the survey results suggest that recruiter confidence is high, they also indicate that talent shortages still plague many employers and industries.

Help us predict the future of the job market. Take the July 2021 Recruiter Recruiter Index® survey now.

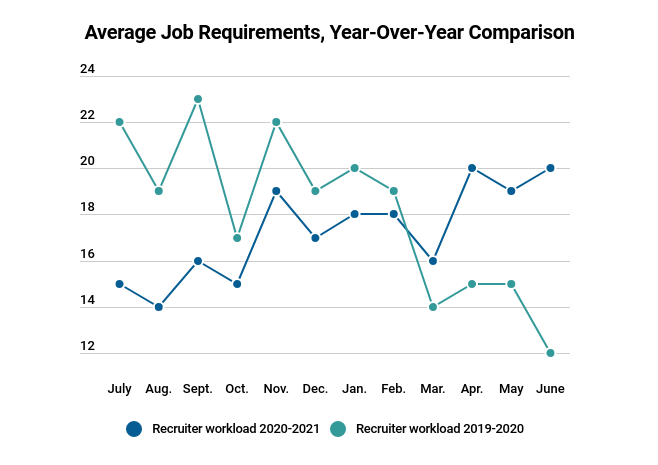

Overall recruiter sentiment, which measures recruiter optimism about the current and future state of the job market, remains steady at 3.8, tying March and May as the highest months on record. Average roles per recruiter are up from 19 last month to 20 this month, which is a 67% increase in workloads from the previous year.

Sentiment is scored on a scale of 1-5, with 1 being "Highly pessimistic about the job market's current and future prospects" and 5 being "Highly optimistic about the job market's current and future prospects."

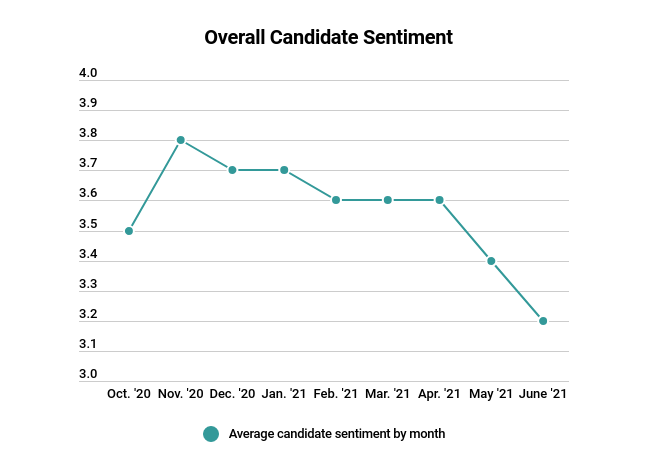

At the same time, candidate sentiment fell for the second consecutive month, from 3.4 in May to 3.2 in June, indicating candidates are less interested in new job opportunities. 40 percent of recruiters say the average number of applicants per role has decreased since May. Taken together, these numbers indicate that widely reported talent shortages may be growing more severe.

Sentiment is scored on a scale of 1-5, with 1 being "Candidates are not interested in new job opportunities" and 5 being "Candidates are highly interested in new job opportunities."

"You have to really drill into why are candidates staying at home, why are they not even interested?" said Recruiter.com Chairman and CEO Evan Sohn in an interview with CNBC's The Exchange. "Are they taking the summer off? Are they only going back to where there's going to be remote work?"

Employers are taking a few different approaches to attract candidates in this tight talent market.

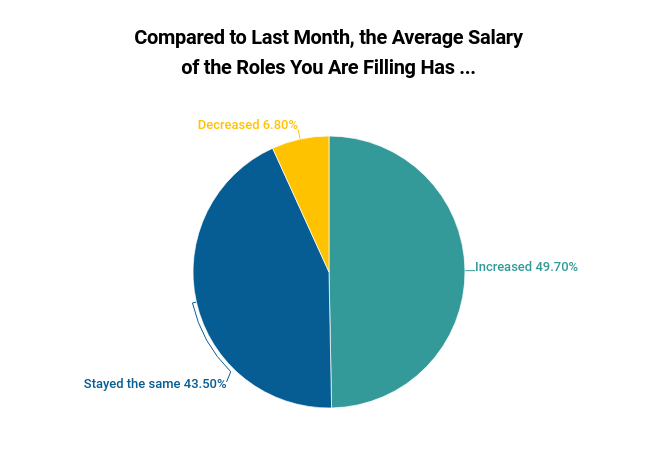

- Raising salaries: Half of recruiters said the average salaries of the roles they're recruiting for have increased over the last month, up from 42 percent in May.

- Changing requirements: 67 percent of recruiters said the majority of their open roles require college degrees, down from 71 percent last month, suggesting employers are loosening their requirements in the hunt for talent.

- Working with recruiters: Demand for recruiters and talent acquisition pros surged in June. Survey respondents said recruiting/staffing was tied with medical/healthcare for the second-most in-demand kind of talent in June.

Despite these efforts, declining applicant volumes suggest candidates may be holding out for better offers.

"If you were a candidate, and last month you saw someone offering [a salary of] X dollars more, and this month you're seeing even more money, maybe you'll just wait around for a higher number," Sohn told The Exchange.

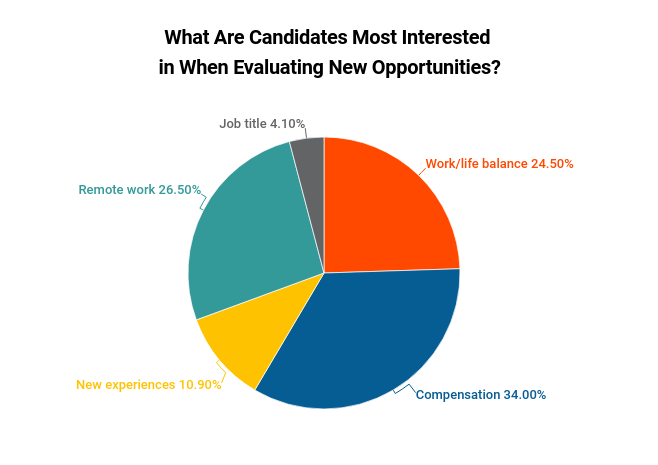

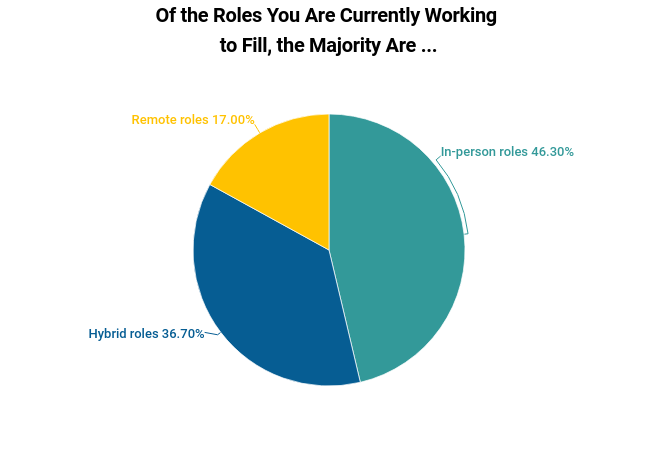

While remote work is No. 2 on candidates' list of priorities when evaluating new roles, employers are set on returning to the office, according to the Recruiter Index®. In fact, only 17 percent of recruiters said they are primarily working on remote roles, the lowest share of remote roles on record.

"Companies are actually saying, 'Hey look, I know we have a talent shortage, I know we're going to have to pay more for people, but I still want them to be in the office, at least for a period of time,'" Sohn told The Exchange.

When recruiters were asked which talent they're seeing the most demand for, the top 10 included:

- IT/software engineering: 33 percent (+1 percent from May)

- Recruiting/staffing: 16 percent (+7 percent from May)

- Healthcare/medical: 16 percent (-3 percent from April)

- Financial services: 9 percent (+1 percent from May)

- Food/beverage: 9 percent (+1 percent from May)

- Hospitality: 9 percent (-1 percent from May)

- Logistics: 7 percent (-2 percent from May)

- Manufacturing: 7 percent (+3 percent from May)

- Architecture/engineer: 5 percent (first time on list)

- Skilled Trades/construction: 5 percent (-3 percent from May)

For more results from the latest Recruiter Index® survey, download the full report here.

Recruiter.com Group, Inc.

Recruiter.com is an online hiring platform delivering on-demand recruiting technology and services to both large and small businesses. With AI and video technology, and the world's largest network of recruiters, Recruiter.com delivers on-tap recruiting that flexes with hiring needs.

To learn more, visit https://www.recruiter.com.

For investor information, visit https://investors.recruiter.com.

Please follow social media channels for additional updates:

LinkedIn Recruiter Network Group: https://www.linkedin.com/groups/42370/

LinkedIn Company Page: https://www.linkedin.com/company/1240434

Twitter Company Page: https://twitter.com/recruiterdotcom

Facebook Company Page: https://www.facebook.com/RecruiterDotCom

Investor Relations:

Dave Gentry

RedChip Companies, Inc.

dave@redchip.com

Phone: (407) 491-4498

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words "forecasts" "believe," "may," "estimate," "continue," "anticipate," "intend," "should," "plan," "could," "target," "potential," "is likely," "will," "expect" and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements primarily on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, and financial needs. Important factors that could cause actual results to differ from those in the forward-looking statements include continued demand for professional hiring, the accuracy of the Recruiter Index® survey, the impact of the COVID-19 pandemic on the job market and the economy as virus levels are again rising in many states, and the Risk Factors contained within our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2020. Any forward-looking statement made by us herein speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by law.