Insights and Predictions From the Recruiters, HR Professionals, and Talent Acquisition Experts on the Front Lines of the Job Market Today

Job Market Overview

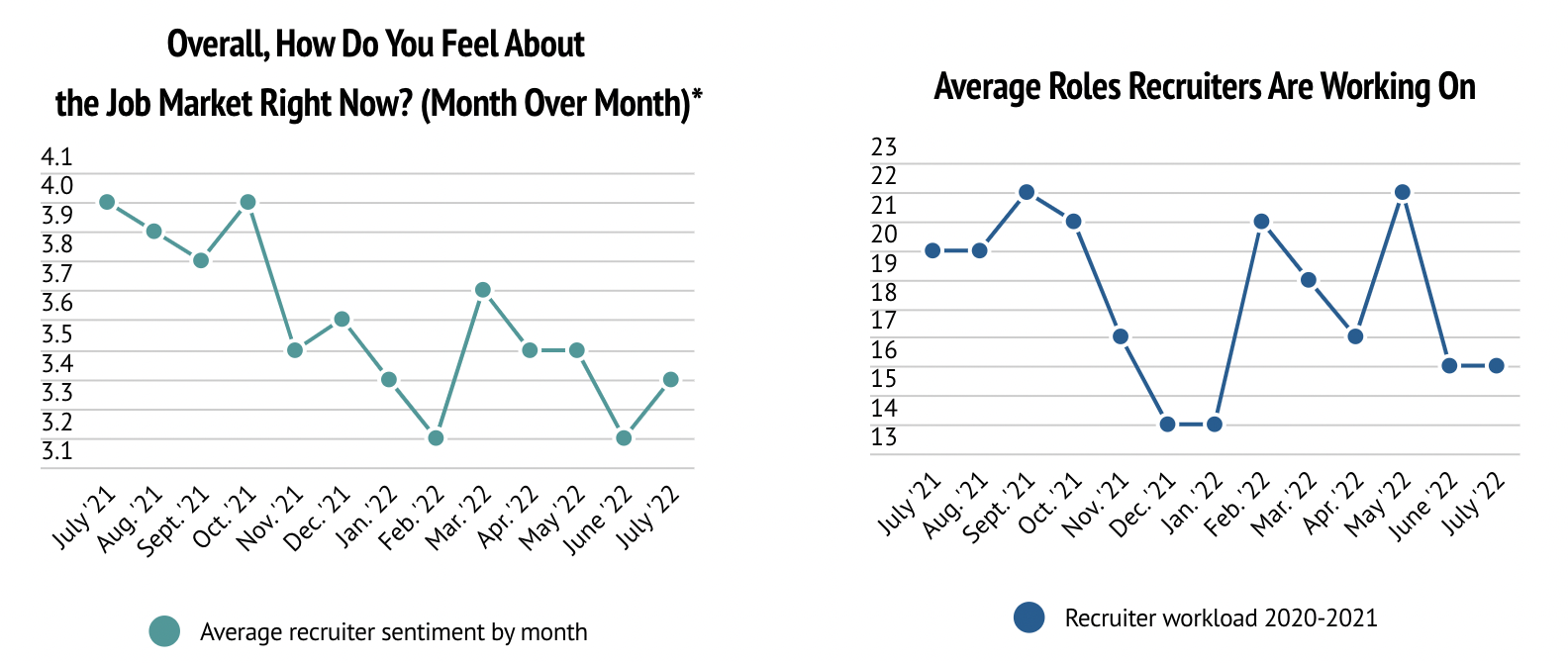

The average recruiter sentiment increased this month to 3.4, well below where it was this time last year, but back on an upward trend. The average amount of roles recruiters are working on was 16 - holding steady since June.

Candidate Close Up

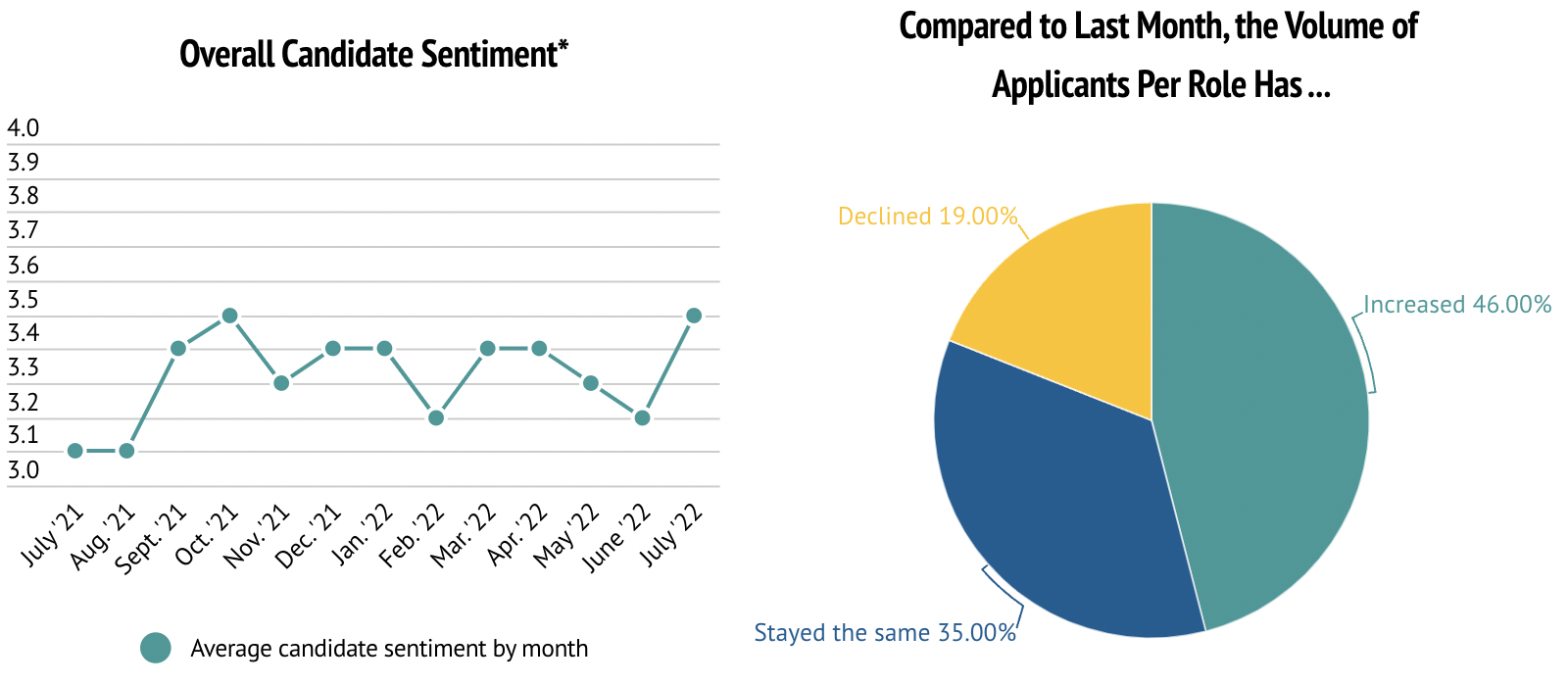

Candidate sentiment witnessed an uptick this month jumping to 3.5 - the highest it has been all year. The index reported a big increase in the volume of applicants per role this month, jumping 77 percent since June, when only 26 percent of recruiters reported applicant volume increasing.

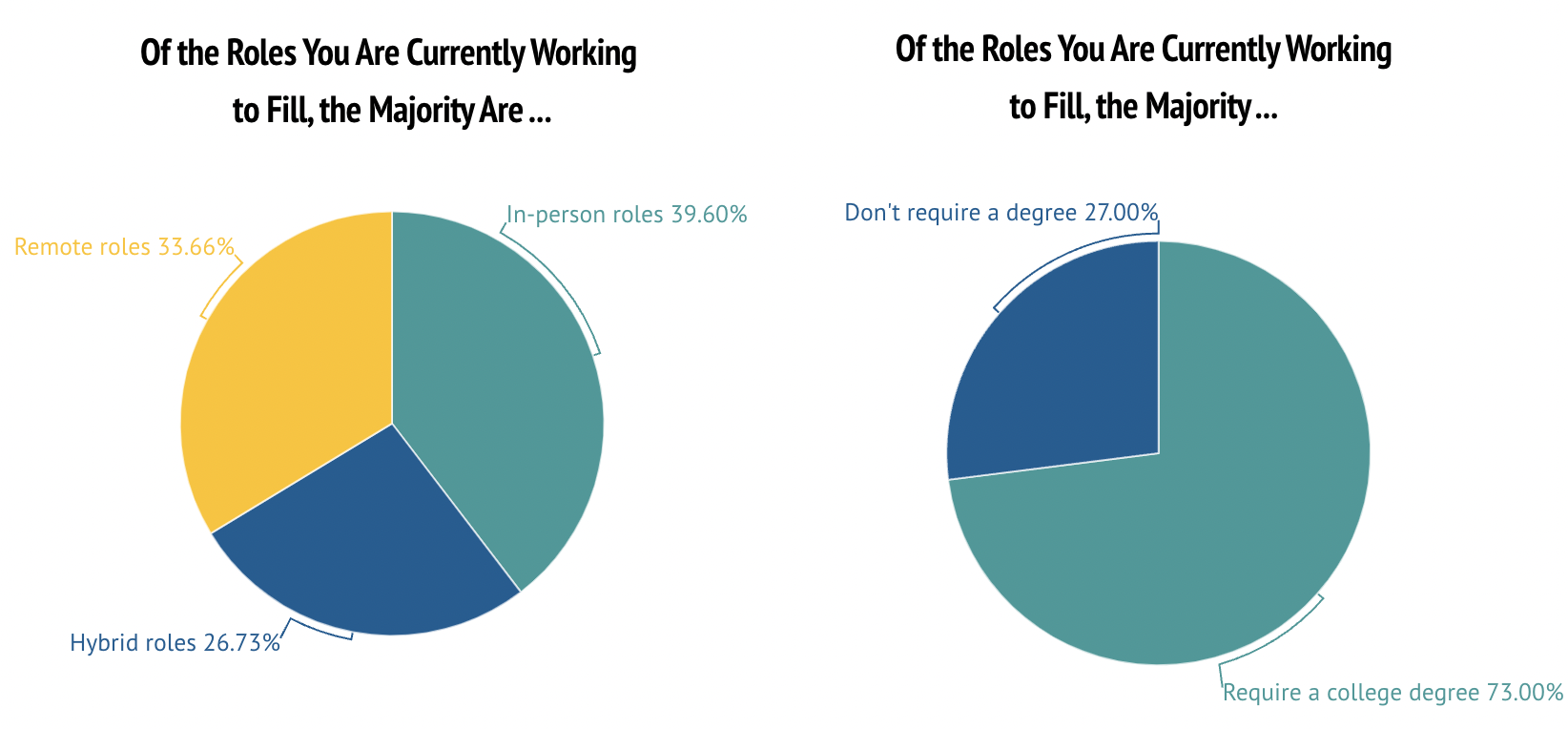

Although in-person roles witnessed a slight decrease this month from 42% in June, they still remain the number one type of position recruiters are working to fill, followed by fully remote roles and then hybrid.

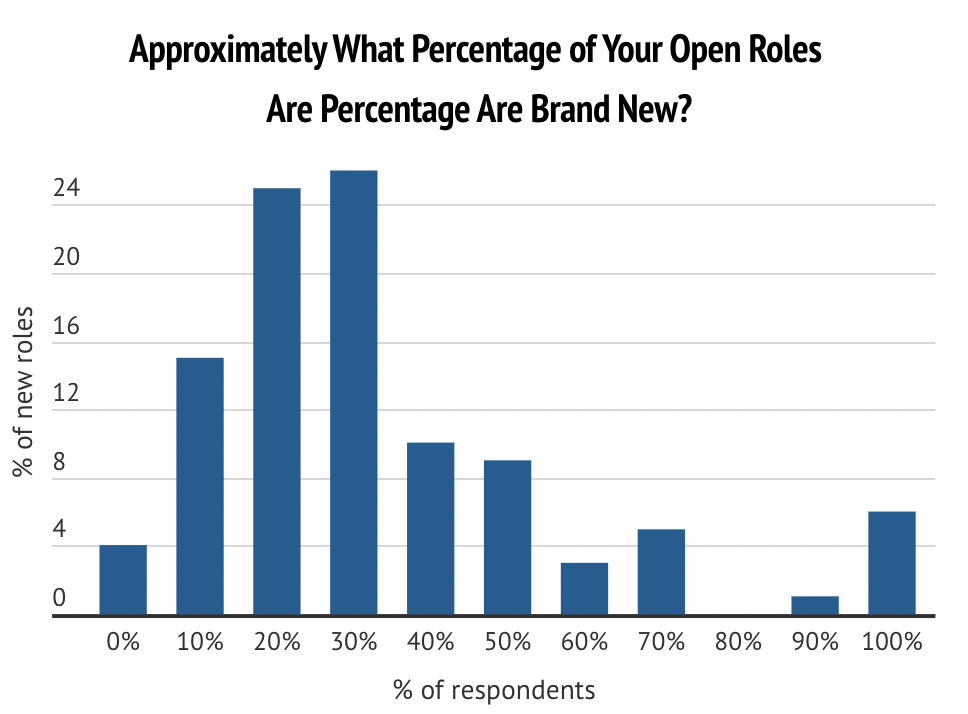

Our Recruiter Index tracks how many of the roles recruiters are working on are backfill vs. new roles. This month, only six percent of recruiters said that 100 percent of the roles they were working on were brand new roles and a quarter of recruiters said only 20 percent of their roles were brand new.

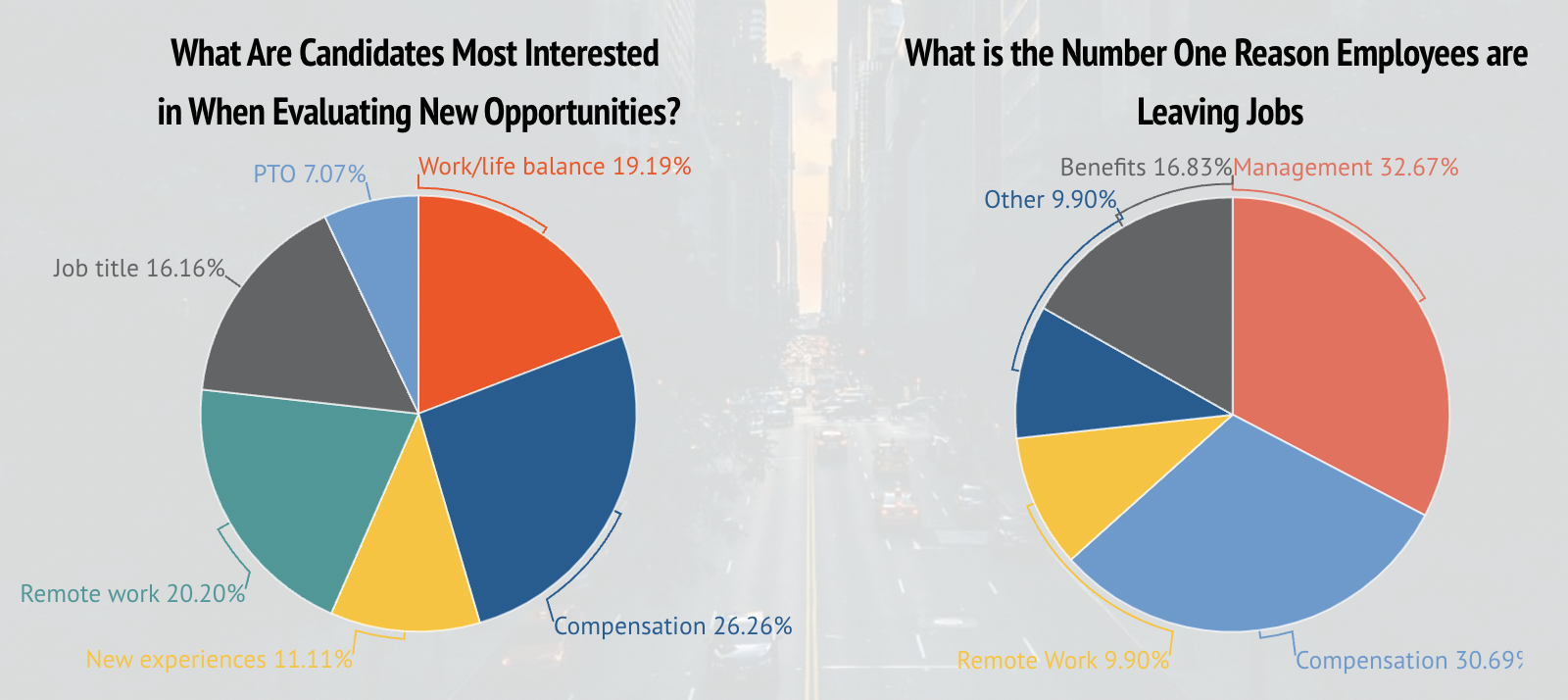

Compensation remained the number one priority for candidates in the market for a new job, followed by remote work and work/life balance. Management overtook compensation as the number one reason candidates were leaving their current jobs. Following management was compensation and benefits, which increased by 240% since June.

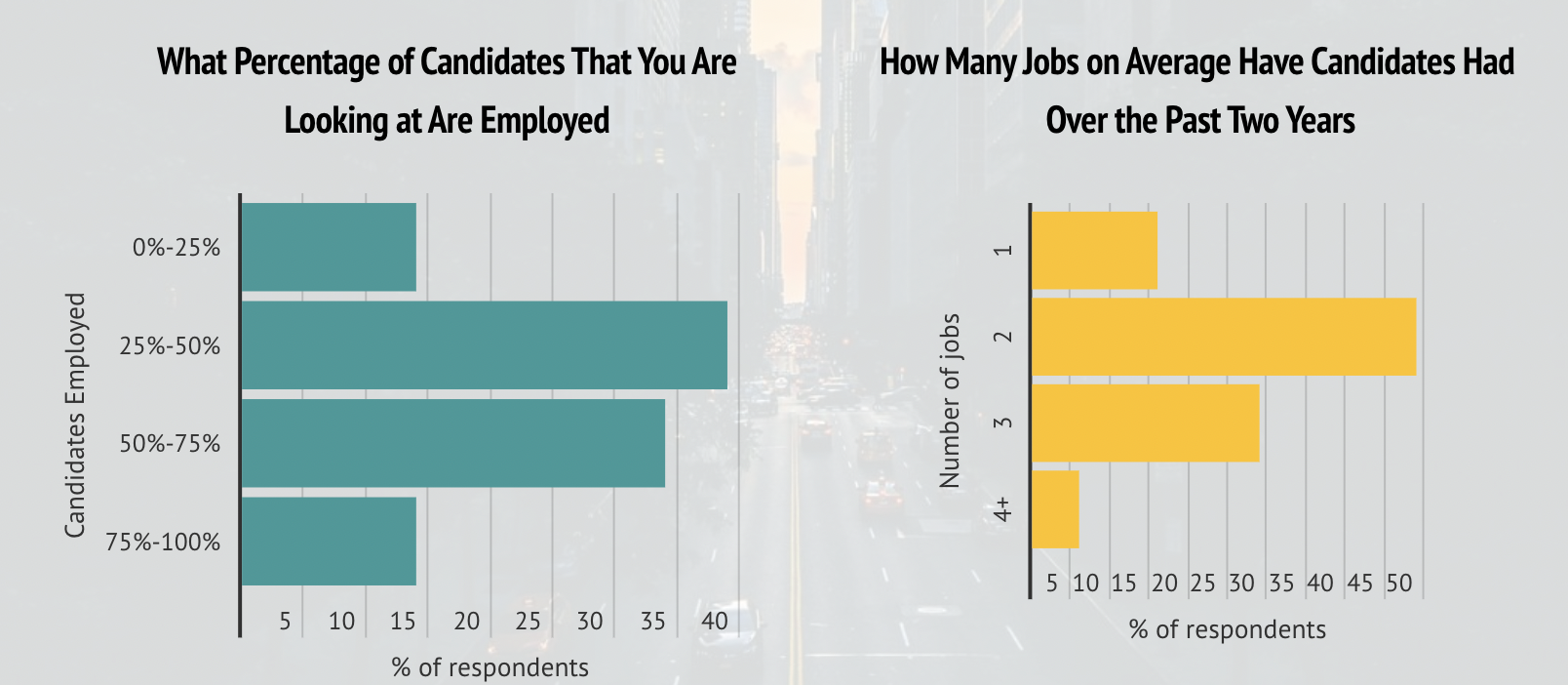

The July Recruiter Index showed that of the candidates recruiters are talking with 34 percent reported that half to 75 are currently employed. While keeping the job hopper economy in mind, 49 percent of prospective candidates have had two jobs over the past two years and 29 percent have had three jobs over the past two years.

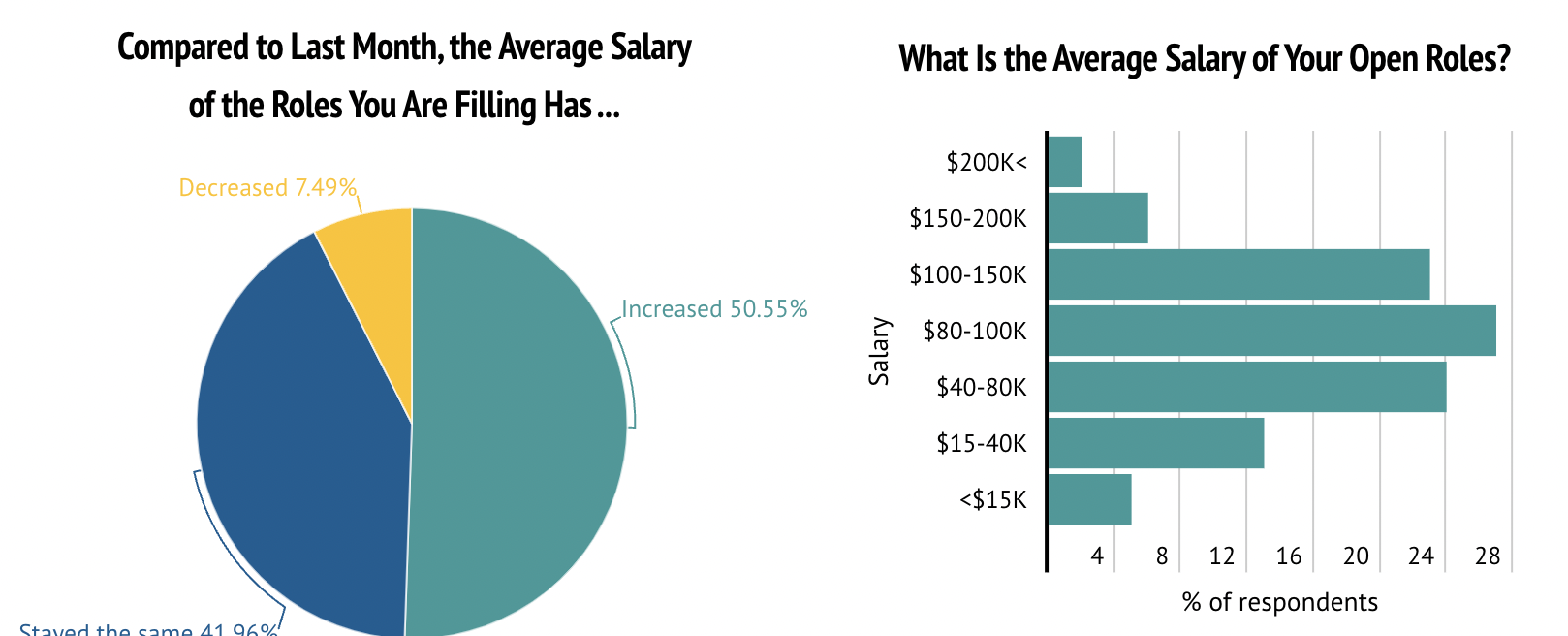

The majority of recruiters reported salaries increasing in July, jumping 42 percent since June. In terms of specific salary ranges, we saw increases in the ranges <15K (+2 percentage points), $40K-$80K (+5 percentage points), and $80K-$100K (+8 percentage points).

Most Active Industries

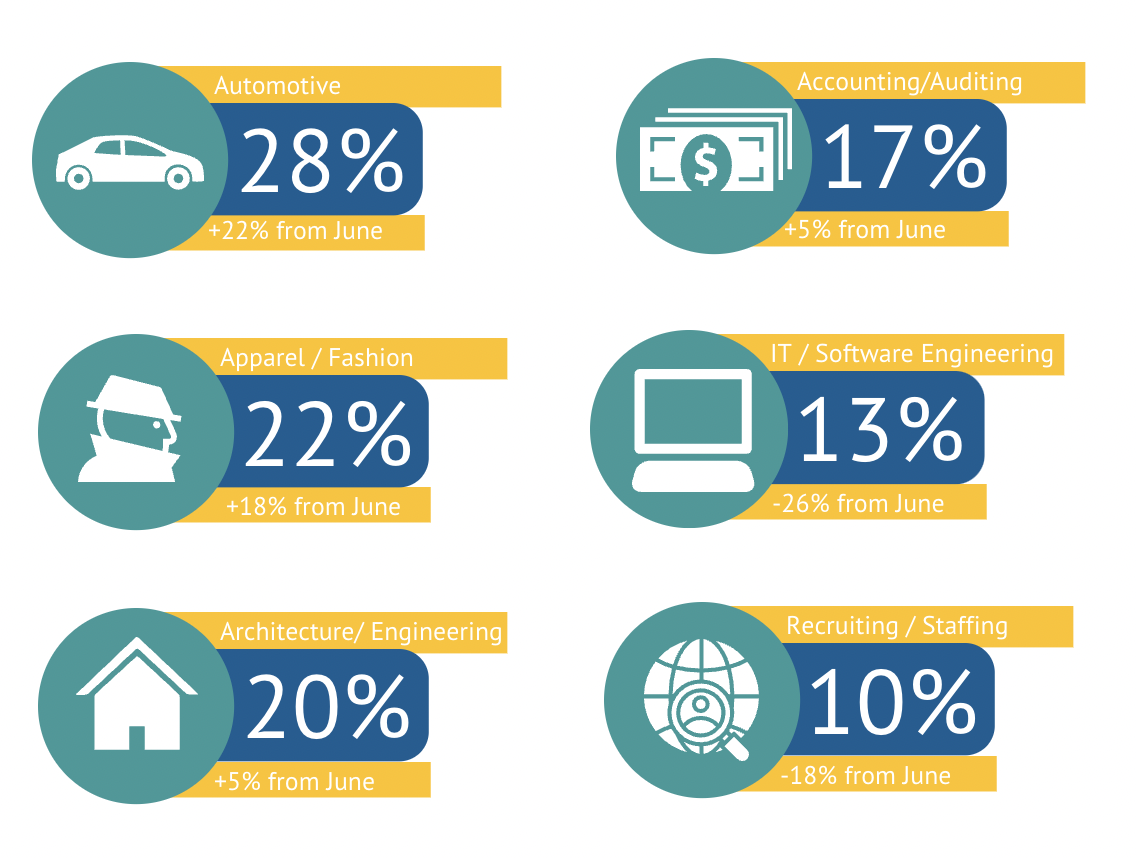

We asked recruiters across all verticals to identify the top three industries where demand for talent was highest in July.

IT / Software Engineering decreased in demand by 67 percent since June, as automotive jumped to the number one spot having 28% of recruiters name it the most in demand industry.

Following automotive was apparel / fashion ranking second, and architecture / engineering.

Key Takeaways

-

Recruiters worked on an average of 16 open roles in July 2022, holding steady from June.

-

The average recruiter sentiment by month is calculated by asking how recruiters feel about the current job market. This month it increased to 3.4.

-

Candidate sentiment, a measure of how open candidates are to new roles, increased to 3.5 - the highest it has been all year.

-

Although in person roles decreased this month, they continued to overtake both remote and hybrid roles, with 40 percent of recruiters working on in-person roles.

-

Only 6 percent of recruiters reported 100 percent of their roles being brand new.

-

Compensation continued to be the number one priority for candidates looking for a new job, while management became the number one reason employees are leaving their current jobs.

-

IT / software engineering dropped to the number five spot when it came to in-demand industries, dropping 67 percent since June. Automotive claimed the number one spot with 28% of recruiters naming it the most in-demand industry.